After a stable January, Swiss watch exports grew 3.4% in February 2019. This is even despite a high comparison base, as exports grew more than 10% in February 2018. it’s a good sign that there may be additional room to run for the Swiss watch industry. Total exports totaled CHF 1.8 billion in February 2019, slightly higher than January’s CHF 1.6 billion total.

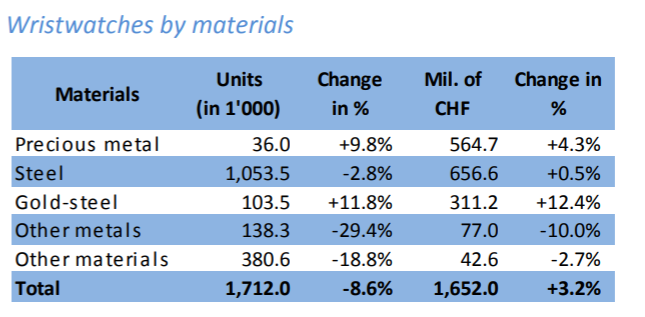

In a trend we’ve been tracking for awhile now, precious metal and bi-metal (gold-steel) watches drove much of the growth, while steel exports were stable. Gold-steel exports saw the most growth, with a 12.4% bump in terms of CHF sold.

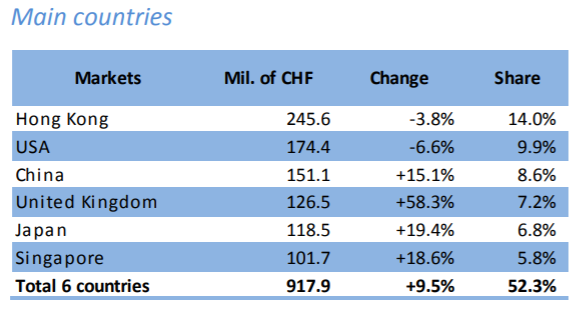

The top five geographic markets will remain familiar, though the United States saw a drop of 6.6% in exports year-over-year. This is in part due to a high base effect, though other countries had similar effects. The United Kingdom seems to be back on track, after an unusually slow early 2018. We’ll blame that on Brexit, because anytime something goes wrong in the UK, that seems to be the culprit.

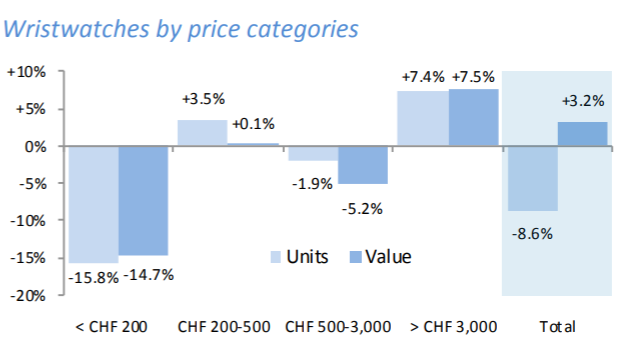

As has been the trend, the growth was driven by the high end of the market (>CHF 3,000). The drop in exports under CHF 200 has been even more pronounced than typical to start 2019.

As bloggers and brand boys gather in Basel for Baselworld 2019, they should have a little pep in their step knowing that the industry is still strong.

Visit FHS for all the statistics.